Summary of

transactions for June 2022

Continued

to DCA into QUAL (avg. $121) and IQLT (avg. $33). Sold MCT as I was against the

merger with MNACT. Proceeds from the sale remain in cash as I am slightly

bearish on Reits – further explained below.

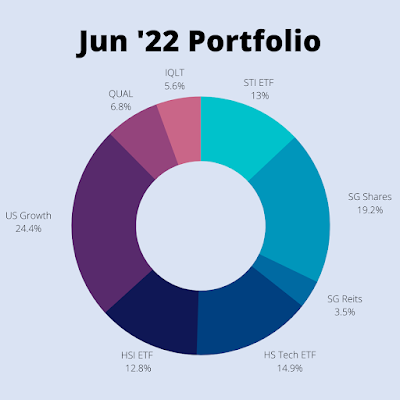

Portfolio

allocation as of June 2022

SG Shares: DBS,

SGX, Valuetronics

SG Reits:

Syfe Reit+

US Growth:

BABA, INMD, PINS, PYPL, SHOP, TDOC, TTD, UPST

On

Inflation and Recession fears

I think it

is key to understand that these two issues can be self-fulfilling.

Demand-side inflation

is driven by expected inflation, that is, if you expect prices to be

higher in a year’s time, then you would be more likely to spend now (on

non-perishables), before prices are higher in the future. Which in turn results

in actual inflation if everyone thinks and acts the same way.

Concurrently,

if employees expect inflation to be high, then they are more likely to

ask for a pay raise, which increases the cost of production for companies.

Companies, especially those with pricing power, would then mark up the prices

of goods and services, in order to pass on some of the costs to consumers. Which

potentially results in a wage-price spiral.

Taken

together, if you ask the average person on the street now, expectations of

inflation are high, and there is the danger that these expectations results in continued levels of elevated inflation.

Recessions

can also potentially be self-fulfilling.

If

households and businesses expect a recession to occur in the near

future, then the likely response would be to reign in spending now. This is

already ongoing, with many companies taking the chance to trim their workforce,

and the US Consumer Sentiment falling sharply in June. In a circular economy,

one person’s spending is another person’s income, and there would be knock on

effects when households and business reduce expenditure. This reduction in

spending and demand can result in an actual recession down the road.

View on

Reits

Real estate

is often touted as an inflation hedge as rents and asset values tend to rise in

tandem with inflation. I generally agree with this view, but I see three

potential headwinds for Reits in the near term:

1) With the

10Y Singapore Savings Bonds yielding 3%, Reits yielding 5-6% may no longer be as

attractive. Prices may have to fall further to maintain a sufficient yield

spread, to compensate investors for the additional risk of holding Reits. I am

generally bearish on Reits with high price to book values, as I believe that

Reits ultimately represent holdings in physical real estate, thus it makes

little sense to pay a huge premium over their appraised values (high P/B ratios) simply for more

“liquidity” or “diversification”.

2) For

Reits with a relatively low proportion of fixed rate debt, the rising cost of

borrowing would hit them hard. While the majority of Reits have fixed or hedged the bulk of their borrowing costs to somewhat mitigate the impact of

rising rates, there would be a direct impact on future acquisitions and refinancing. If we look at the property level, especially in the Singapore

office/retail sector, rates rising beyond 3% would mean that financing of most

SG Office assets would not be feasible. For example, if a Grade A office asset is

valued at a cap rate of ~3% (NPI yield of 3%), then it would make little sense

to finance part of the acquisition with debt as it would be a net negative on

cash flows.

3) The

effect of this is harder to quantify, but a favoured strategy for some Reit

investors would be to purchase Reits on margin. When margin rates were at 1-2%,

it made sense take leverage and purchase Reits that were yielding 5-6% and

profit from the spread. With rising interest rates, it makes this strategy less

lucrative, and leveraged investors would potentially have to deleverage.

That’s all

for this month’s update – for my monthly portfolio summary, please follow my Instagram

Page @alpacainvestments