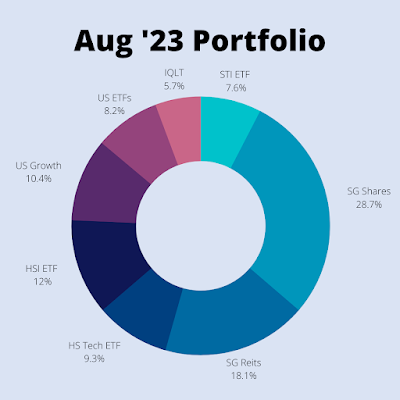

Portfolio allocation as of August '23.

• SG Shares: CDG, DBS, Haw Par, SGX, Valuetronics

• SG Reits: Syfe Reit+, DigiCore Reit

• US Growth: BABA, INMD, PYPL, SHOP, TDOC, UPST

• US ETFs: SCHD, QUAL

August was a decent month for adding to my existing

positions. I bought more of 2800HK amid the China real estate fears, and added

to my Syfe Reit+ portfolio multiple times.

In my previous posts, I have shared about having an asset

allocation target of 50% Singapore, 30% rest of world and 20% China. Recent

events have led me to rethink this allocation, thus I have made the following

adjustments to my allocation targets.

|

|

Previous

Target |

New Target |

|

STI ETF |

10% |

20% |

|

SG Stocks |

20% |

15% |

|

S-Reits |

20% |

15% |

|

HSI ETF |

20% |

15% |

|

Global ETF |

30% |

35% |

Reasons for the change:

- I want the portfolio to be even more passive,

hence actively managed SG Stocks will be reduced to 15%

- Having

a higher weightage towards global stocks (35%) versus China exposure via HSI

(15%) to reduce single country risk

- S-Reits

are under pressure recently due to higher rates, but taking a step back I believe

that there’s a significant principal-agent conflict of interest when it comes

to the structure of Reits. Reit managers are incentivised to grow the AUM of

the Reit via acquisitions, which may not always be in the interests of unitholders.

Additional, Reits are more highly leveraged as compared to an average equity index, thus the impact of “mistakes” can be more costly, e.g. if a Reit has a relatively high gearing ratio, a small drop in asset values may cause the Reit to be in default as debt covenants are breached.

FIRE Musings

Last month’s post regarding “what is work” was rather

well-received. Hence, this post would be a continuation along those lines – dispelling

the notion that “working” should be the default for everyone, eliminating the

fear of (early) retirement, and reaching our early retirement dreams via

dividend investing.

Why is work the default?

When someone talks about wanting to retire early, and shares

that part of their retirement plans involves some volunteer work, pro-work

folks love to say “why can’t you volunteer while working?”.

That’s such an absurd question. I would challenge you to

think, in the first place, why should “work” be the default? Because society

tells us to? Because there’s a stigma against retiring early?

At some level of wealth, work becomes optional. If someone

tells me they’ll retire early and volunteer twice a week, I’d say that’s great,

rather than try to suggest that they should somehow fit volunteering into

their current busy schedule.

Think about it this way:

How volunteering fits into an early retiree’s week: Wakes

up naturally without an alarm. Perhaps spends 1 or 2 days per week working part-time

in a freelance role in an area they’re passionate about, and maybe another 2

days volunteering. The remaining free weekdays can be spent exercising while

the gyms are empty, sitting at a café reading a book or relaxing by the beach

without the weekend crowd. Weekends then can be entirely devoted to family. A

slow pace of life, living intentionally.

How volunteering fits into an ordinary worker’s life: Wakes

up at 7am, 5 days a week. Spends their mornings in rush-hour public transport

packed like sardines. Monday to Friday in the office, juggling their workload,

bosses’/clients’ high expectations, office politics… and then travel back home

in the evening rush-hour, assuming one is lucky enough not to work overtime.

After an exhausting work-week, perhaps set aside 1 day during the weekend to do

volunteer work, which would mean that some family time is sacrificed.

Let me be clear – the above comparison is not to

diminish the efforts of people who manage to carve out time for volunteering

while being employed in a full-time job. I think these people are truly altruistic

and deserve our respect.

My point regarding the above comparison, is that if someone expresses

their view that they want to volunteer as part of their early retirement lifestyle,

that should be celebrated. Rather than questioning why

can’t they fit volunteering into their current lifestyle, because obviously

volunteering while holding on to a full-time job involves massive trade-offs,

that not everyone is prepared to take.

Eliminating the fear of (early) retirement

Recently, I had a conversation with ourmoneydreams – a

Singaporean couple in their early 30s who would likely reach financial independence

in within the next year (in their early/mid-thirties). They wondered if their account

would still be worth following if they retired early (rather than posting updates

about their journey to early retirement, which is what most finsta

accounts do).

I’d say that posting about the life of an early retiree is

probably far more interesting, simply because so few people actually get to retire

early! It would be wonderful to get insight on how they spend their time, but

equally as important, their fears and insecurities and how they manage

them.

Many people fear early retirement because it is so unusual. There’s

even a fear of traditional retirement, because people who’ve worked for 30 to

40 years reach the point where their jobs becomes their identities! Articles

fear-mongering about losing “purpose”, losing “structure”, and the like… are

extremely hilarious to me. Thus, I believe that sharing the lifestyle of an

early retired couple would be extremely beneficial to those looking to achieve

the same dream.

There was a reddit post on SGFI asking “Those who achieved

FIRE, how are you passing your days?”.

I shared this blog from a fellow Singaporean blogger, RB35,

who managed to retire at 33 in 2018. He continued blogging to share about his

early retirement lifestyle, which I found extremely inspiring.

There was a response to my comment that “he went back to

work in the end”, as if to point out something went wrong with his early

retirement plans.

In reality, RB35 went back to “work” for 2 more years because

he couldn’t travel freely due to Covid, which was how he spent 2018-2019. Not

because of monetary issues. RB35 retired at 33, went back to “work” for 2 years

at 35/36, and has now retired again at 37/38. Which is still way earlier

than most folks and I’d say that’s still pretty amazing.

Pro-work folks like to jump up and yell “checkmate” whenever

FIRE folks face the slightest of setbacks. What’s the obsession with what other

people choose to do with their lives? Do you spend your entire life hoping that

some early retiree will screw up their retirement plans, so that you can jump

in and say “I told you so”?

If people get to retire early, I genuinely feel happy for

them. I think it is fantastic to be work-optional. People who reached financial

independence are generally happier. And having more happy people is good. There’s

zero envy from me. It really doesn’t matter to me how they came to that

wealth.

Whether you retired early because you won the lottery,

received an inheritance, built and sold a business, made 100x your money in

crypto… or for the rest of us in the 99%, through working and investing

aggressively, it doesn’t matter to me. As long as we reach financial

independence, I don’t think there’s a difference how we got there. What

matters would be, at that level of wealth, how do we plan for a sustainable

retirement?

Criticism of dividend stocks

Another warped perspective that I’ve seen is someone questioning

why Singaporeans prefer dividend stocks, rental income, or generally any cashflow

based instrument, rather than investing for “growth”. I am not sure what’s the

issue here. What I can say is, I’m certain that someone like AK71 with SGD 200k+

of dividends annually, would definitely not be complaining.

I am more than happy to continue to perpetuate this

preference for dividend stocks on this blog. The irony is that from a dividend

investor’s perspective, it would be fantastic if these naysayers choose

to shun dividend stocks, if there’s less demand for dividend stocks, we get

higher yields on our investments – please don’t buy dividend stocks, so

that I can get them at cheaper prices!

If I were to summarise the above 3 points into a sentence,

tying together my views regarding work, retirement and investing for dividends,

it’d just simply be:

I’d rather be unemployed with 5k/month of passive

income, than be employed and earning a 5k/month salary.

The former is (almost) permanent, the latter is not. I don’t

think it gets simpler than that.

Well said! Working towards fire via dividends too!

ReplyDeleteNice post, the path less travelled does not mean it is a bad path. Sometimes some people might not be equipped with enough financial knowledge to know the path.

ReplyDeleteThe odd thing here is, a lot of rich people live off their income, so it is weird to criticise the FIRE dream.

ReplyDeleteThe point I will concede is that not doing anything with your free time, although that is your right, is a waste of human potential.

Do you see a lot of disdain for FIRE in your daily interactions?

I wouldn't say there's "a lot" of disdain, but the FIRE movement is definitely controversial to many.

DeleteI think FIRE detractors generally have some envy or resentment towards early retirees, or perhaps due to their own greed or "never enough" mindset, feel that increasing their wealth into perpetuity (via employment income) is the way to go.

I honestly have no issues with people wanting to work / loving their jobs - in fact I have repeatedly mentioned that these people are more "valuable" to the economy. I only take issue with people who constantly tell me that I should continue working even if I've hit my FIRE targets, because I am firmly in the "work to live", rather than "live to work" camp.

There are some FIRE detractors who are more concerned about the financial aspect of retirement. Some may have accumulated significant wealth, but are still worried about retirement not working out financially. These conversations would centre around safe withdrawal rates, sequence of returns risk, asset allocations etc, which I appreciate and respect their views.

In real life and through this blog, I know many early retirees who lead interesting, fulfilling lives, so I don't think most early retirees choose to "not do anything" with their lives. Interestingly, a good number engage in part-time work as well. I believe most people still want to work - and for early retirees, the bargaining power lies entirely in their hands to hop around until they find something that suits them.

Although if by "not do anything", you actually mean "not doing anything economically productive", then I'd agree with that statement. It is true that the average early retiree would probably contribute less to GDP growth, productivity, income taxes etc, as compared to the average employed person. But I genuinely don't see anything wrong with that. To me, "work" is nothing more than something popularised during the industrial revolution (as I wrote in last month's entry)

I think FIRE critics often try to imply some moral / societal / ethical perspective on early retirees. Whether people who retired early are “productive” members of society is in itself a philosophical debate, which I don't think there's a definitive answer.