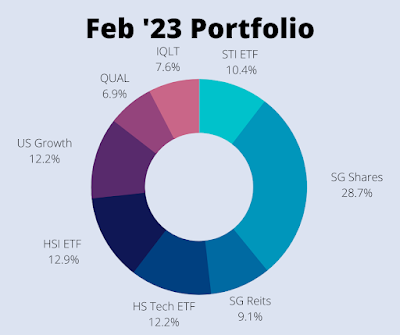

Feb 23 Portfolio Update

Portfolio allocation as of Feb '23.

• SG Shares: CDG, DBS, SGX, Valuetronics

• SG Reits: Syfe Reit+

• US Growth: BABA, INMD, PYPL, SHOP, TDOC, UPST

Not much to update this month – I mainly added a small

amount to my Syfe Reit+ portfolio, as interest rate fears once again puts

pressure on S-Reits. This is part of my regular DCA strategy as I work towards

accumulating $20k in S-Reits on Syfe. I am clear that my objective is to just

achieve market returns for S-Reits and thus will continue to build my position,

even though the outlook for Reits may be rocky.

A few months back, I wrote that I was closely watching the

US Office Reit sector, and was looking at Keppel Pacific Oak Reit (“KORE”) in

particular. Against the backdrop of some office landlords defaulting on their

loans – Pimco ($1.7bn, Office assets across the US), Brookfield ($755m, 2

offices in LA) and Blackstone ($562m, Office assets in Finland), I decided that

KORE will drop off my watchlist.

In last month’s update I also wrote about my interest in Haw

Par. It was trading at $9+ at that time, then shot up to $11+ within a few

weeks, and is now back at the $9 level. I did some further research over the

past week and I think it is a compelling opportunity for me in the coming weeks.

With the SVB crisis, things would probably get volatile

again in the coming weeks, but as I’ve said multiple times before, I think

having a diversified portfolio, investing prudently and consistently and having

a long-term oriented mindset will be the best way of riding out any volatility.

Meanwhile, I will continue to collect my dividends – current

run rate stands at around $4k for the year, and well on track to hit the $6k

target for 2023.

FIRE musings – some Thoughts on Finding Purpose

Let’s talk about “purpose” today.

Recently, a friend shared about their longer-term career

goals, about what they would like to have achieved at the end of their career.

They work in a tech role and therefore will likely be very well compensated

during their career, but yearn for a greater “purpose” or “impact” on the world.

This friend shared that an option would be to work at a Big Tech firm, or

perhaps even become a quant in finance. But they want something more

“meaningful”. For example, working on how artificial intelligence can be

applied to the medical field. For them, the main decision at this point would

be between money, or money and purpose. I think that’s great, and I feel

happy for them to be able to find their ikigai. This person is

incredibly capable and talented, and definitely deserves the best of both

worlds.

This conversation led me to think further about finding

purpose, and what it means to me.

A common misconception is that “purpose” has to come from

work. I mean if you can find purpose from your work, or deliberately look for

jobs that have “purpose”, then that’s great. Even better if you get paid well

for it. You are lucky.

But “purpose” to me can come in many forms – it could be

from volunteering, it could be from nurturing your children, it could be from

being a caregiver to your elderly parents… and much more.

I think that at least for the vast majority of folks, during

their search for employment, do not have “purpose” at the top of their list –

instead focusing on factors such as compensation, job progression, job scope and

so on. After all, “purpose” doesn’t pay the bills.

Then, after settling into a role, some might attempt to

rationalise and find “purpose” in their roles, perhaps as a way to justify

their chosen field. It is easier to find purpose in some jobs than others, for sure. A

teacher’s purpose might be “to educate the future generation”, or a healthcare

worker’s purpose might be “to help my patients recover well”.

But for a good number of private sector employees, what can they

say? If you work in the securities desk at a bank, you might say something

abstract like, to paraphrase Lloyd Blankfein, “we are selling this security to

clients who wanted exposure to the housing market…” (lol) Or, for someone working at

a tech firm and whose role is to write algorithms to literally get people

addicted to social media, what can they say?

Therefore, I think for the vast majority of folks, this

whole job and purpose thing should be viewed as a “good to have” rather than a

“must have”. Don’t be too fixated on this.

What is my purpose then?

I believe that writing this blog gives me purpose. It is

always nice when people write to me to tell me that I’ve positively impacted

their financial independence journey. I love it when a new finsta account tells

me that they’ve been following my account for some time, and finally decided to

start to document their own financial independence journey as well.

All these Singaporean financial independence accounts come

from a variety of backgrounds, some are recent graduates and have just began

working, while some are families with kids and in their 30s and 40s. Some have

even achieved Barista FIRE or FIRE.

I think what’s great about this community is that, at least

from my perspective, while we are clear that we are all running our own races,

we still celebrate the triumphs and success of others. For me, I recognise that

we all have different starting points, different circumstances and different

priorities, thus it is clear that some will achieve FI faster than others. Yet,

I believe that we can still learn a great deal from what others share,

especially from those in a similar situation or those who have walked a similar

path before. The focus is on sharing positive financial habits with the

ultimate goal of achieving Financial Independence. At that point, the option to

Retire Early will always be on the table.

I think we should all do more to uplift each other, rather

than having a dog-eat-dog mentality where people look to put each other down –

as seen in some forums or groups where people constantly argue over whether a

starting salary of $X is realistic or not, or whether a net worth of $Y by a

certain age is attainable or not… all I can say is – the sky’s the limit.

Thus, I would like to give a shoutout to the people who I’ve

crossed paths with on Instagram. These are Singaporeans who have embarked on

their personal finance / financial independence journey and have been sharing

their progress. In no particular order:

Sincere apologies if I missed anyone out – do let me know

and I’ll be happy to update this list :)

Thus, to sum up, my purpose would be to share the ups and

downs of my financial independence journey, and hopefully, inspire others to

embark on the same as well.

If you want to go fast, go alone. If you want to go far, go

together.

Hi Alpaca,

ReplyDeleteThanks for the wonderful list. It is very timely as I start to aggregate other forms financial news into my site.

Enjoy the journey to FIRE!