A belated update for 2022 as I have been procrastinating, as

usual. Wishing everyone a Happy Chinese New Year and may the Year of the Rabbit

bring you good health, happiness and wealth. Wealth is placed third, because

simply having this without the first two is meaningless.

2022 was largely a good time to deploy capital – being a net

purchaser of equities means that I am happier when stocks go down rather than

up – giving me opportunities to buy more on the cheap. My invested capital

increased by 72% from a year ago (although I had invested more, as this does

not account for capital losses), while dividends received increased by 75%.

When I planned out my FIRE journey in Dec 2021, I projected “total net worth”

targets for each year – I am glad to say that for end-2022, I achieved 102% of

my target. Some other thoughts to wrap up the year:

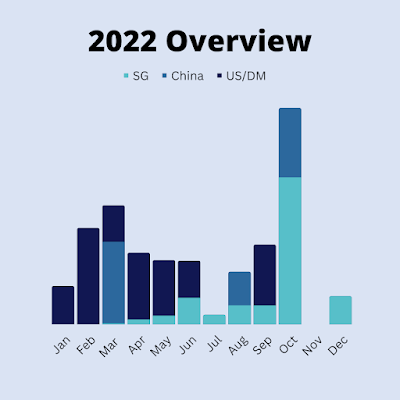

1. Diversification

I’m invested across SG, China, US and Developed Markets. The

current target asset allocation would be to have 50% SG exposure, 20% in China and 30% in US/DM.

This is still a work in progress as I’m yet to be fully invested.

I think 2022 highlights the risks of overly focusing on a

specific market – often the US. What’s interesting is that the often-overlooked

SG market is one of the top performers globally. I’d rather over-diversify and

settle for a lower average return, than expose myself to huge idiosyncratic

risks related to a specific company, country or sector, as many have learnt the

hard way in 2022. As mentioned in my blog post a year ago (“Seeking FIRE – Route to Financial Freedom”), I am targeting a 5.5% long-term CAGR on my 100% equity

portfolio, which I believe is reasonable.

3. Skepticism & Biases

Most people are aware of the inherent conflict of interest

that banks and brokers have, that is, you’ll usually see research reports advising

people to “Buy” stocks, because these firms are incentivised to get people to

trade more frequently.

But when it comes to taking advice from Youtubers/Finance Influencers,

I find it ironic that few people realise that conflicts of interest exist as

well, albeit from a different angle. There is a clear conflict of interest

because sensational and click-bait headlines draw the most views, thus these

“gurus” are incentivised to make bold claims about “when the Fed pivots”, or

that “the market has bottomed”. Basing your investment decisions on these often

does not end well.

Thus, be skeptical whenever consuming such content, and

always do your own due diligence. If I ever become a content creator, please

apply the same level of skepticism to me as well.

Dec 2022 Summary

For Dec ’22, I mainly increased my positions in S-Reits via

Syfe Reit+. I had intended to initiate positions in DigiCore Reit and Keppel

Pacific Oak Reit (“KORE”), but these did not reach my intended entry levels.

After Manulife Reit reported a significant decline in asset valuations which

brought their gearing level to just a whisker away from the 50% limit, I think

I will hold off buying KORE now. I think the day of reckoning for Reits has

finally arrived – where capital values are likely to fall and put pressure on

gearing levels. But I must add, that I had expected the same scenario to play

out nearly 3 years ago during the March 2020 Covid crash, which ultimately did

not materialise. For now, I think my exposure to S-Reits is still manageable at

8%, as I am passively holding most of the blue-chip S-Reits.

The “actively managed” component of my US portfolio has

declined relative to my SG stock picks since Q3 ’22, this is largely due to my

efforts to increase my dividend income. However, I expect to increase my US

allocation and am looking at GOOGL and ADBE. These are my top picks, although

we shall see what other opportunities surface along the way.

As a continuation from the above about “being skeptical”, I

am not going to make any predictions on what 2023 will look like for the

markets. Instead, I’ll say, invest not because you expect the markets to go up

tomorrow, this month, or even this year. Rather, as a long-term investor you

should be investing only because of one simple reason – you expect that in a capitalistic

society, capital (being an asset owner) will outperform labour (being an

employee) in the long run. Thus, you believe being an asset owner is the best

way to protect your capital against inflation, be it equities, fixed income,

commodities or real estate.

In 2023, my goals are, in the order of priority, (1)

increase dividend income, (2) increase proportion of passive investments, and

(3) work towards my target asset allocation of 50% SG, 20% China and 30% US/DM.

Pro-work vs Pro-FIRE

Let me end off with a short section on the pro-work vs

pro-FIRE debate. I know I’ve written on this multiple times, but a LinkedIn

post by someone who got retrenched by Google yesterday made me feel like writing on this

again.

The author of the post wrote that after 16 years at Google,

he was simply laid off via email. One line in the post stood out for me. He

wrote: “This also just drives home that work is not your life, and employers

-- especially big, faceless ones like Google -- see you as 100% disposable. Live

life, not work.”

To me, the fact that employees are largely dispensable forms

my baseline when thinking about FIRE. Reaching FI is your insurance policy against the unpredictable nature of corporate life, while having the choice to RE gives you the power to live your own life, rather than being stuck on the hedonic treadmill. Thus, when people say things like “you

should work harder, create more value for your company” and so on… Please don’t

be naïve and think that one can be indispensable. Employment is simply a means

to an end to me – to build my life, and my dreams. At the end of the day we are all dispensable. The earlier you realise that, the better, because that means that you'll start working towards building your safety net.

I find it absurd when pro-work folks say “I like to work. So,

you should like to work too. Please don’t retire early”. Because on the other

hand, pro-FIRE folks rarely go around telling people “I want to retire early. So,

you should retire early too. Please stop working”.

Of course, a well-intentioned person might say “Please don’t

retire early until your have an absolutely robust financial plan” I

think that’s totally valid. I welcome these comments, which help pro-FIRE folks

identify any blind spots in their early retirement plans.

I think when it comes to the pro-work vs early retirement

debate, there’s an implied philosophical perspective as to whether FIRE folks

are “contributing” to society. Let’s not be naïve here and I’ll say that I’m

fully aware that if everyone wanted to retire early, society is screwed. We can

already see that happening in the US, with the falling labour force

participation rate post-Covid partially contributing to inflation, as there’s a

shortage of workers who decided to retire during the pandemic (hey – life is short;

although many had the tailwind of rising markets).

But that’s a bigger issue for governments and corporations

to tackle, not me. Perhaps some form of wealth tax, dividend withholding tax and/or

capital gains tax will address the issue and make it more prohibitive to retire

early. But we all know the in capitalistic Singapore, this is unlikely

at the moment. We’d be shooting ourselves in the foot given our aspirations to

become a leading wealth management hub.

Personally, I view the decision for one’s retirement age from

a laissez-faire perspective – that ultimately, one has to be responsible

for the choices they make, and deal with the consequences of their choices. The

choice to retire early or not should be entirely up to the individual, once a

certain level of financial independence has been achieved. I don’t think I am

in the position to impose my views on others. I can only share my perspective.

Thus, if you’re pursuing financial independence and early retirement,

may the fire in you continue to burn strongly. We will get there. Have a

good year ahead.

.png)

As employees, we should pursue FI for more options like taking a break , free lancing, part-time when happened to be retrenched and not necessary FIRE!

ReplyDeleteYes, very good advice. the possibilities that FI opens up are endless!

DeleteWah not bad! 15% in quality ETF. There are UCITS version if you are interested. Do ping me if you cannot find it.

ReplyDeleteThanks Kyith. Yes, I am aware of the UCITS options. Another reader had expressed a similar view in my previous post. I think the main one to look for alternatives would be IQLT, given that it makes little sense to hold a US listed, ex-US ETF which incurs a higher WHT than its UCITS counterpart.

Delete